cdtfa locations|cdtfa district offices : Clark Field Operations Division. Office hours are 8:00 a.m. to 5:00 p.m., Monday through Friday excluding state holidays. Appointments are recommended. Call your . O site Meu Jogo do Bicho faz a cobertura dos sorteios da Lot.

0 · cdtfa sales tax by county

1 · cdtfa office locations near me

2 · cdtfa office locations

3 · cdtfa number lookup

4 · cdtfa locations in california

5 · cdtfa field offices

6 · cdtfa district offices

7 · cdtfa directory

8 · More

Remastered - STEAMUNLOCKED » Free Steam Games Pr.

cdtfa locations*******Office Locations & Addresses. The California Department of Tax and Fee Administration (CDTFA) offices do not accept cash as a method of payment. You may contact your local CDTFA office to request an exemption if you are unable to pay your . Field Operations Division. Office hours are 8:00 a.m. to 5:00 p.m., Monday through Friday excluding state holidays. Appointments are recommended. Call your . The California Department of Tax and Fee Administration is responsible for the administration of 37 different taxes and fees. See Tax Rates.

Toll-free: 1-800-400-7115. Outside the US: 1-916-445-6362. California Connect (TTY): 711. (for hearing and speech disabilities) CDTFA “Legal Rulings of Counsel” – Exempts rulings from California’s Administrative Procedures Act (APA). The statutory definition of “legal rulings of counsel” .

The G&H Fee Account Number – also known as the CDTFA number – is nine digits long with no letters, spaces, or dashes. The fee applies to each generator of hazardous . Oregon Field Offices. Contact Industry Operations for questions or information relating to: Firearms (FFL) or explosives (FEL) licenses. Licensee firearms . This section provides information on current and historical payment statements, quarterly distribution summary reports, disbursement calendar, advance .

How to Use This Guide. Each section of this guide contains important information about local and district taxes for local jurisdictions and districts (and their representatives). .This program provides cash that families can use to pay for things they need while they work toward supporting themselves. The amount of money a family gets depends on .The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate, and any district tax rate that may be in effect. State sales and use taxes provide revenue to the state's General Fund, to cities and counties through specific state fund allocations, and to other local jurisdictions.GENERAL. CDTFA-530, Schedule C, lists the addresses of all your places of business for which seller's permits have been issued. Locations within a single city, or within the unincorporated area of a single county, are grouped. Each group is separated from the following group by a space and an asterisk (*).

CDTFA-401-INST REV. 29 (2-24) STATE OF CALIFORNIA. CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION Instructions for Completing CDTFA-401-A, State, Local, and District Sales and Use Tax Return You Can Easily File Your Return Online Filing your return online is an easy and efficient method of filing your sales and use tax return.For payment options, visit our Online Services Payments page. If you are calling from outside of the 48 contiguous states, please call 1-916-445-6362 or complete our online form to reach our Customer Service Center. CRS: 711. Unless otherwise noted all offices are open 8 a.m. to 5 p.m. Monday-Friday, excluding state holidays. Credit card services may experience short delays in service on Wednesday, June 26, from 7:00 p.m. to 11:00 p.m., Pacific time, due to scheduled maintenance.. Online Services Limited Access Codes are going away. Visit our Limited Access Code Removal page for scheduled removal dates and instructions on how to Sign Up Now for a . You may contact your local CDTFA office to request an exemption if you are unable to pay your taxes without cash. For payment options, visit our Online Services Payments page. If you are calling from outside of the 48 contiguous states, please call 1-916-445-6362 or complete our online form to reach our Customer Service Center. Credit card services may experience short delays in service on Saturday, June 22, from 2:00 a.m. to 3:00 a.m., Pacific time, and on Wednesday, June 26, from 7:00 p.m. to 11:00 p.m., Pacific time, due to scheduled maintenance.. Temporary Office Closure: Due to construction, the Ventura Office will be closed to the public from June 17-21. .

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. The use tax generally applies to the storage, use, or other consumption in California of goods .

The sales and use tax rates vary depending on your retail location. A base sales and use tax rate of 7.25 percent is applied statewide. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. District tax areas consist of both counties and cities.

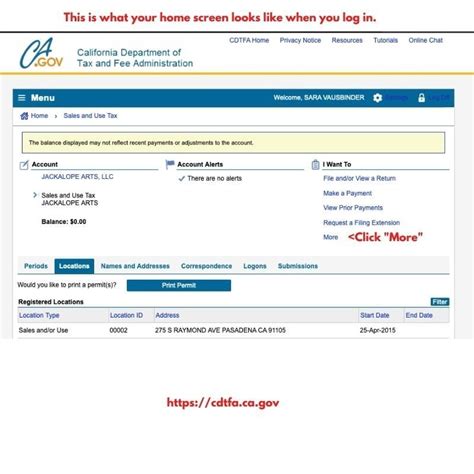

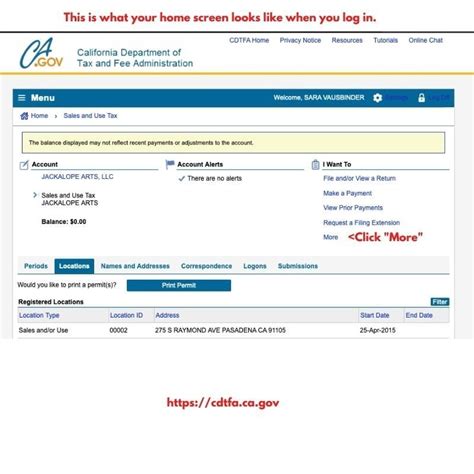

Enter your name as registered with the CDTFA. Do not enter the corporate, partnership, LLC or other business entity name in this field. If you are not an owner and are trying to register as an E-Client with the CDTFA, please call our customer service representatives at 800-400-7115, Monday through Friday, 7:30 a.m. to 5:00 p.m. Pacific .CDTFA-345- REV. 15 (FRONT) (1-21) STATE OF CALIFORNIA. NOTICE OF BUSINESS CHANGE. ACCOUNT NUMBER (required) (example: XXX-XXXXXX) . New Business Location Add New Sublocation New Account Mailing Address New Customer Mailing Address New Books and Records Address. OLD ADDRESS (street, city, state, . Credit card services may experience short delays in service on Saturday, June 22, from 2:00 a.m. to 3:00 a.m., Pacific time, and on Wednesday, June 26, from 7:00 p.m. to 11:00 p.m., Pacific time, due to scheduled maintenance.. Temporary Office Closure: Due to construction, the Ventura Office will be closed to the public from June 17-21. .Online registration is a convenient, fast, and free way to register online for a permit, license, or account with the CDTFA. Register Online. Tax & Fee Rates. The California Department of Tax and Fee Administration is responsible for the administration of . Online ServicesOverview. Online Services. We offer a variety of online services that make completing your CDTFA business easy and efficient. Using our online services, you can file a return, make a payment, submit a claim for refund, file an appeal and much more. If you have an online services profile, log in with your username and .

CDTFA-345- REV. 15 (FRONT) (1-21) STATE OF CALIFORNIA. NOTICE OF BUSINESS CHANGE. ACCOUNT NUMBER (required) (example: XXX-XXXXXX) . New Business Location Add New Sublocation New Account Mailing Address New Customer Mailing Address New Books and Records Address. OLD ADDRESS (street, city, state, .

Credit card services may experience short delays in service on Saturday, June 22, from 2:00 a.m. to 3:00 a.m., Pacific time, and on Wednesday, June 26, from 7:00 p.m. to 11:00 p.m., Pacific time, due to scheduled maintenance.. Temporary Office Closure: Due to construction, the Ventura Office will be closed to the public from June 17-21. .cdtfa district officesCalifornia Department of Tax and Fee Administration Homepage. Temporary Office Closure: Due to construction, the Ventura Office will be closed to the public from June 17-21. Online Services Limited Access . Credit card services may experience short delays in service on Saturday, June 22, from 2:00 a.m. to 3:00 a.m., Pacific time, and on Wednesday, June 26, from 7:00 p.m. to 11:00 p.m., Pacific time, due to scheduled maintenance.. Temporary Office Closure: Due to construction, the Ventura Office will be closed to the public from June 17-21. .

The California Department of Tax and Fee Administration (CDTFA) administers California's sales and use, fuel, tobacco, alcohol, and cannabis taxes, as well as a variety of other taxes and fees that fund specific state programs. CDTFA administered programs collect over $90 billion annually which in turn supports local essential services .(1) Location of Audit. Audits generally take place at the location where the taxpayer's original books, records, and source documents relevant to the audit are maintained, which is usually the taxpayer's principal place of business. A taxpayer's request to conduct the audit at a different location shall include the reason(s) for the request. Sales Delivered Outside California (Publication 101) Sales tax generally does not apply to your transaction when you sell a product and ship it directly to the purchaser at an out-of-state location for use outside California. Your sale is not taxable if you: Ship the product directly to the purchaser using your own delivery vehicle or another .cdtfa locationsThe statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect. Sellers are required to report and pay the applicable district taxes for their taxable .

At the time you apply for a permit, be sure to provide information for all business locations so that the CDTFA will issue the correct type of permit. Is there a fee charged for a seller's permit? No. However, the CDTFA may require a security deposit to cover any unpaid taxes that may be owed if, at a later date, the business closes. The .Filing your final tax, fee, or surcharge return. Sales after closing out your account. Successor’s liability and tax clearances. Changes in ownership. If you have questions that are not answered in this publication, please visit www.cdtfa.ca.gov or call our Customer Service Center at 1-800-400-7115 (CRS:711).

Temporary permits are issued to individuals with no permanent place of business, and cover a selling period of 90 days or less at one location. The registration process is the same whether you are registering for a temporary seller's permit or a seller's permit for a permanent business location.to selling operations lasting no longer than 30 days at one location. Additional information is available on our website at . www.cdtfa.ca.gov, or you may contact our Customer Service Center at 1-800-400-7115 (TTY:711), Monday through Friday, 8:00 a.m. to 5:00 p.m. (Pacific time), except state holidays. What does “engaged in business” mean?

8 de out. de 2023 · Idioma do áudio: Inglês, Francês, Italiano, Alemão, Espanhol, Português. CRACK: ADMINCRACK. Download Monster Hunter: World FULL .

cdtfa locations|cdtfa district offices